Jan. 3 Update. Here's an interactive view of the railroads 13f filings for 3Q. It's pretty straightforward. Call if you want to talk about the data or software or whatever is on your mind.

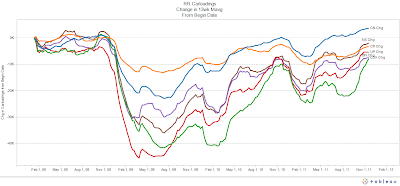

GBX has had a nice rebound since 3Q. CSX sold off sharply in 3Q and hasn't gained many new friends.

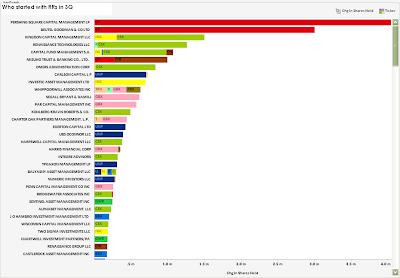

UNP and CNI are core holdings. Even though Pershing Square bought a ton of CP, it's not that big a part of their portfolio.

This tells us who the indexers are....

The big rails were for sale in 3Q - look at the border color.

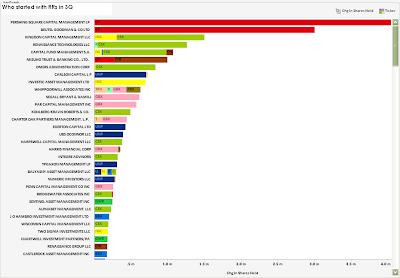

Out of CSX. (Not me. though)

CP caught more than Ackman's attention.

Most big owners added stock in the 3Q selloff.

Leaving for good. Close outs.

Taking a chance. New positions.

If you'd like to trial the EZviz Portfolio software send us an email or give us a call. It's free.

And if you are deeply interested in specific railroad traffic and operating performance check out this

BNSF report.

ail

ail