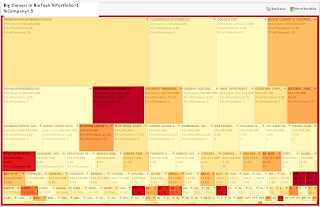

IR and MU....crushed. And they don't like funds. Mutual or otherwise.

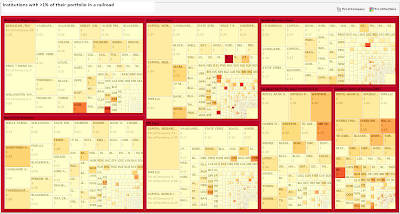

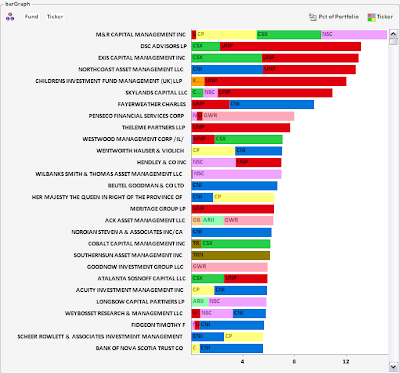

FRScalls demonstrates the power of visual analysis software combined with financial data. We have developed an innovative analytics engine for market and portfolio analysis with examples below.