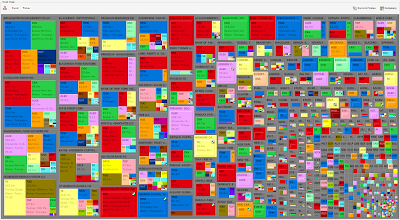

FRScalls demonstrates the power of visual analysis software combined with financial data. We have developed an innovative analytics engine for market and portfolio analysis with examples below.

30 November 2011

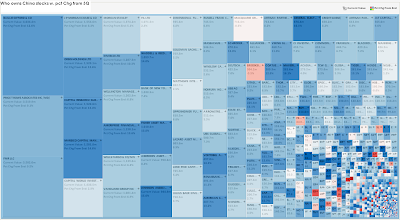

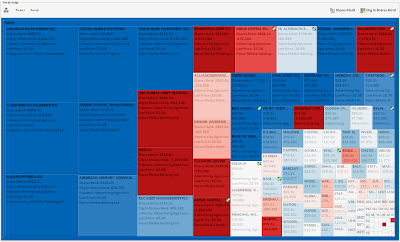

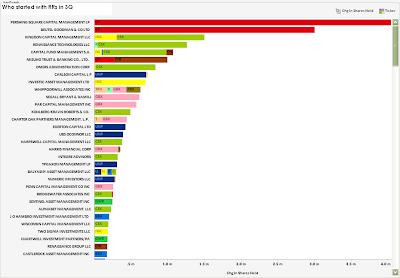

Who are the big owners of GS' list?

A little hard to read but ask for a trial version and you can see it in all its detail.

Just the holders on the GS list with >4% of their portfolio in a particular name. This cuts out the indexers. Color shows net buyers or sellers by shares in 3Q.

These managers are the true believers in GS' fave list.

Who owns China?

29 November 2011

Who cares about AMR?

28 November 2011

23 November 2011

Where is the recession? Still in Europe. Not RRs.

Rail traffic looking good. Esp for BNSF as coal looking strong. Good for Buffett I suspect although it will get lost in the mush at BRK.A

Here's the link to our railfax.transmatch.com graphs.

Pershing Square not so bad

DMND cuts the Momos

22 November 2011

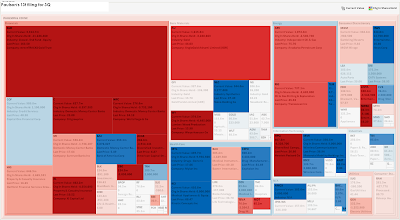

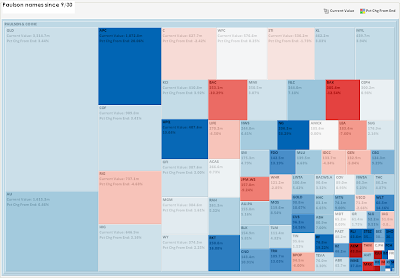

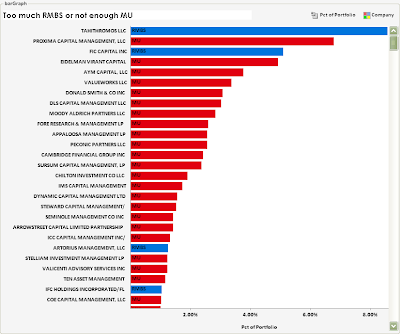

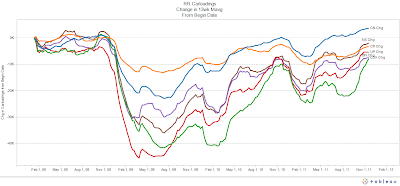

Who cared about carloadings in 3Q?

Jan. 3 Update. Here's an interactive view of the railroads 13f filings for 3Q. It's pretty straightforward. Call if you want to talk about the data or software or whatever is on your mind.

GBX has had a nice rebound since 3Q. CSX sold off sharply in 3Q and hasn't gained many new friends.

UNP and CNI are core holdings. Even though Pershing Square bought a ton of CP, it's not that big a part of their portfolio.

This tells us who the indexers are....

The big rails were for sale in 3Q - look at the border color.

Out of CSX. (Not me. though)

CP caught more than Ackman's attention.

Most big owners added stock in the 3Q selloff.

Leaving for good. Close outs.

Taking a chance. New positions.

If you'd like to trial the EZviz Portfolio software send us an email or give us a call. It's free.

And if you are deeply interested in specific railroad traffic and operating performance check out this BNSF report.

Bad day for these shipowner owners.....

21 November 2011

China Names Cracked Up - Risk Off

Who bet big on risky Chinese companies? No surprises on the list. This is what outfits like Baillie Gifford get paid to do viz. gamble your money on wacko Chinese companies that probably won't be around in five quarters. If you can't read the smaller holders it's because you didn't download the trial version of our software. See link above and get it.

They owned FMCN. But why?

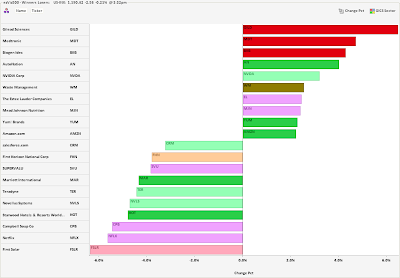

Losers

Who did what with DNDN in 3Q?

18 November 2011

17 November 2011

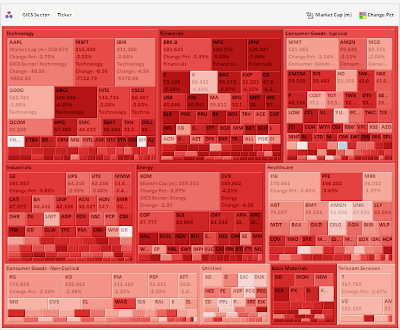

If the North American economy is OK, then what?

Yup it's Thursday and Europe remains a mess and railroad traffic keeps chugging higher. Who are you going to believe? Railfax or CNBC?

16 November 2011

15 November 2011

14 November 2011

Who sold IBM shares to Buffett?

IBM Buyers - red means new position

and Sellers - blue means sold out

13fs are starting to pile up (although Berkshire's doesn't come out until tonight). Apparently there were lots more big sellers than buyers (x Berkshire). We'll revisit this in a few days when we have more data....

download EZviz Portfolio to see all the 3Q filers

11 November 2011

10 November 2011

Railroad Traffic Ticks

Rail Traffic Still Pretty Strong according to Railfax. Don't get too upset by slight downturn. It's November FCS. We won't really know if there's an the impact from an Italo-Greek slowdown until next spring.

Green Mountain turning Red

09 November 2011

Subscribe to:

Comments (Atom)