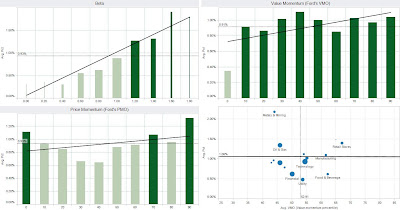

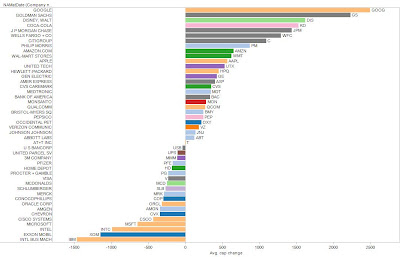

FRScalls demonstrates the power of visual analysis software combined with financial data. We have developed an innovative analytics engine for market and portfolio analysis with examples below.

30 March 2010

23 March 2010

Green Pie for the Cyclicals

22 March 2010

16 March 2010

11 March 2010

08 March 2010

05 March 2010

04 March 2010

Another Dull Trading Day?

I'm not afraid to say it. It's dullsville out there. February was a month when the premature economy bulls outvoted the fighting the last war bears. Maybe tomorrow's payrolls will decide. As you know we collect and distribute RR numbers. Once you get below the industry totals (take away coal) you get the strong impression that it will be spring in a few weeks. Maybe the market will warm up too.

An Interactive List of over 25,000 Money Managers

Mailing lists. Don't you love em? If your business demands that you market or sell to investment advisors you should be interested in our new ADV product. Over 25,000 names addresses phone numbers and websites. And each and every one of these IAs, hedge funds, mutual funds and brokers wants to hear from you. Well maybe not all of them. But at least now you won't call someone who's too big or located in the wrong part of the state. If you want an interactive trial please give us a call at 347 293-1776 and we'll get you going. Cold calls welcome.

We also run over 3000 13fs updated with realtime pricing. We can give you a pretty good idea of how everyone else is doing today and why.

Some weakness for techs otherwise waiting

Who caused the crash?

Earlier today Felix Salmon responded to Bob Rubin's claim that it was all GWBush's fault. Felix listed several other candidates for the blame. http://bit.ly/c8N0QE Lots of overlap so I had to use my own judgment. You can agree or disagree. Make your own pie chart. I'd have to agree w/ Felix that it was mostly bank managements' greed and ignorance that was largely to blame. I think Dick Bove would disagree. But he's a twit. Or is he?

03 March 2010

Careful Study of Wealth Mgmt Firms

The map shows the money managers in CT with assets of less than 150M (to eliminate the bias of the larger firms). These firms should more closely serve (and reflect) their local markets rather than national and international clients. My conclusion is that there is a lot of money in the Greenwich-Westport corridor. And not much in places like Bridgeport,Waterbury and Torrington. Who'd a thunk it.

Well I know where the money is in CT. And so do you. This gets really interesting when you look at states and cities you've never been before. I didn't know where the nice parts of Houston were before. There isn't much money in Detroit but there's a lot in the northwest suburbs.

02 March 2010

01 March 2010

The Investment Advisors who file ADVs with the SEC

Click to see an interactive version.

with assets less than $100m. If you are interested in the money mgmt business we'll hook you up with an interactive version of this map including >25ooo names, phones and websites.

Subscribe to:

Posts (Atom)